What is DeFi and why is it the hottest ticket in Crypto?

An introduction to decentralized finance

By Wendy’s Whitepaper contributor @LibertyRaider

For daily news, reviews, and educational content on all things crypto subscribe to CryptoWendyO on YouTube, and follow on TikTok and Twitter

DeFi or decentralized finance refers to financial services using smart contracts, which are automated enforceable agreements written in computer code that do not need an intermediary like a bank or broker. They run on an immutable public online blockchain like the technology bitcoin uses.

Blockchain or Distributed Ledger Technology (DLT) was made for disrupting traditional finance. DeFi may have started as the wild-wild-west of the crypto frontier but is quickly being tamed by ambitious startups looking to bring it to the masses. DeFi is the new FinTech.

Explosive growth

Just 6 months ago some thought DeFi was a passing fad or bubble, but the majority of DeFi assets have been created since then and are still growing.

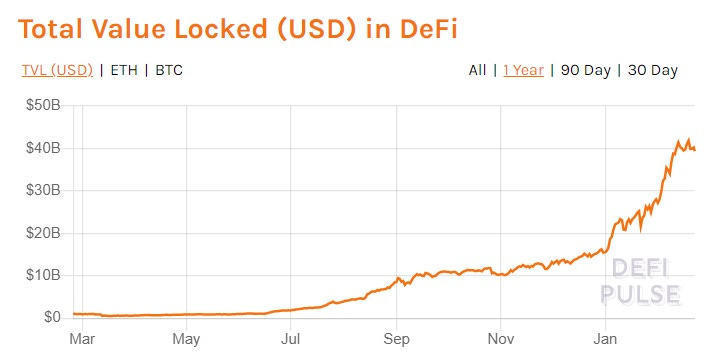

In the last year, DeFi has ballooned from around $1Bn to $40Bn in terms of total value locked (TVL) on Ethereum. As the above chart shows, we could be seeing a top forming as Ethereum fees are becoming too high for some retail traders and investors.

Read Sherpa’s guide to saving on gas fees with Polygon (previously Matic)

However, if we include other chains solving Ethereum’s issues like Binance Smart Chain, Polkadot, Polygon, and Telos, we are over $70Bn in total DeFi Market Cap – yet this represents only a tiny fraction of the $100Tn global financial industry.

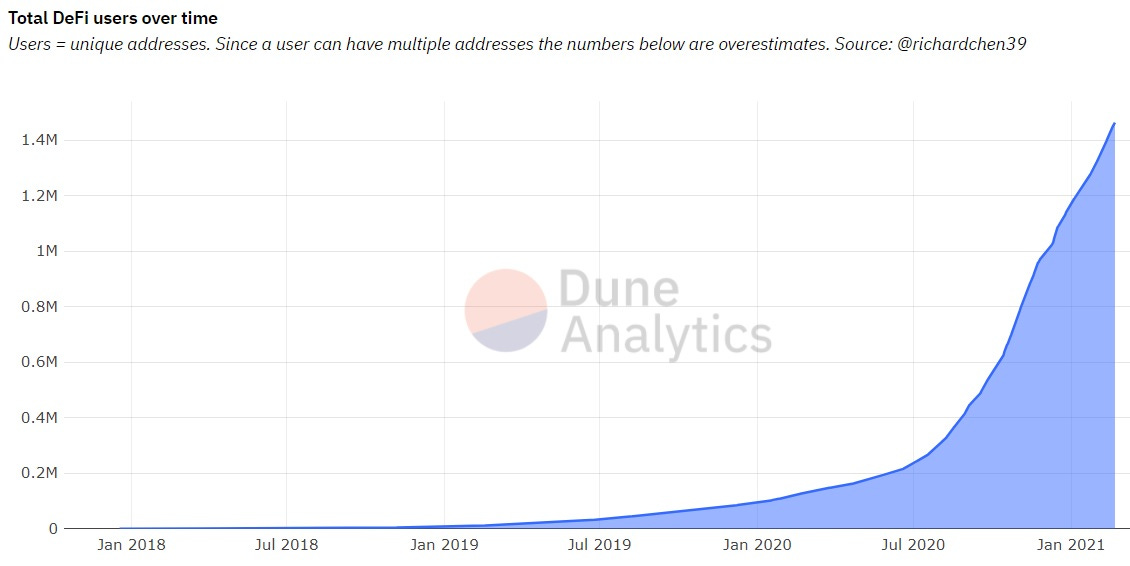

Another metric showing parabolic growth is the number of unique wallet addresses holding DeFi assets.

Maximum disruption

With disruption comes resistance and some think that CeFi or centralized finance (the banks) will never allow DeFi to win. But is it really a zero-sum game when big finance appears to be developing ways to integrate this technology into new and existing services?

When the wave is big enough the giants will either adapt or perish. This is the way – and when there is talk of increased profits in the board room, you can be sure they will be onboard.

Major players from Amazon to Apple and many of the big banks have been openly hiring and developing cryptocurrency services and solutions. It is exciting to hear about a big company accepting crypto, but do you really think they are going to stop there?

DeFi gives us the ability to create an entire digital alternative to Wall Street, but without all the intermediary cost and control. This has the potential to create fair, free, open financial markets that are accessible to anyone with an internet connection and a cell phone.

Now imagine adding the 1.7 billion global unbanked and their $250Bn into the mix. But that is a drop in the bucket compared to what tokenizing formerly illiquid assets like real estate, rents, profits, and gold will bring to the table.

We are about to witness the generational type of disruption that creates massive wealth redistribution and opportunity for those ready to take advantage of it.

What can this do for me?

The flood of new money rushing in is creating investment and trading opportunities with huge gains previously unheard of for retail investors. Who does not wish they bought $AMZN for a dollar?

There are also the financial products themselves. Lend out your crypto to earn interest and rewards by the minute and not the month. Earn at 10% instead of the meager half percent that the best traditional savings accounts have to offer.

There are some great apps like Voyager already available doing all the tech stuff in the background, so you just need to make your deposit and let it happen. Note that most of these require KYC (Know Your Customer) and require you to provide identification.

Another way to realize even bigger gains, access lending, borrowing, and decentralized trading, all while remaining pseudonymous, is to interact with the blockchain directly – also known as Web 3.0 and requires a special browser/wallet.

The draw of high APRs in yield farming and staking is hard to resist. Further down the rabbit hole we find rebase tokens and NFTs (Non Fungible Tokens) being used in DeFi. You thought NFTs were just for art? They can be used to represent insurance policies, bonds, securities, real estate, and all kinds of collateral.

Read Sherpa’s guide to yield farming on Polygon (previously Matic)

This can all sound a little overwhelming at first and we are just scratching the surface. But do not worry… It gets easier and we will dive into all this in future articles.

Getting started

The first thing you are going to see when you try to interact with a DeFi app or a popular DEX (decentralized exchange) like Uniswap, 1inch Exchange, or PancakeSwap is a button to connect your wallet.

Start by installing Metamask and becoming familiar with it. Create a wallet (or two) and send some small transactions. Lots of people use it and you will find many willing to help.

Read Dragonwolftech’s guide to bitcoin and crypto wallets

While there are many wallets to choose from, Metamask remains the popular choice for DeFi and you should learn how to use it safely. It is a simple but powerful piece of software in our Web 3.0 toolkit, but it is also very unforgiving if you make a mistake.

I will be covering Metamask safety and good practice next week, so make sure you subscribe for future issues of Wendy’s Whitepaper.

If you found this helpful, feel free to follow me on Twitter @LibertyRaider or toss a few shekels in the tip jar.

BTC: bc1qzq3res0wkltm6j05l33qvl0fe87sk86h2mafjy

Doge: DSLFG8yGjCzfqecyndcuMDBjbmbk4woeTP

Wendy’s Whitepaper Disclaimer: Please be advised that I own a diverse portfolio of cryptocurrency assets, and anything written or discussed in connection to cryptocurrencies– regardless of the subject matter’s content– may represent a potential conflict of interest. I wish to remain transparent and impartial to the cryptocurrency community at all times, and therefore, the content of my media are intended FOR GENERAL INFORMATION PURPOSES ONLY. Nothing that I write or discuss should be construed, or relied upon, as an investment, financial, legal, regulatory, accounting, tax, or similar advice. Nothing should be interpreted as a solicitation to invest in any cryptocurrency, and nothing herein should be construed as a recommendation to engage in any investment strategy or transaction. Please be advised that is in your own best interests to consult with investment, legal, tax, or similar professionals regarding any specific situations and any prospective transaction decisions.